Fixed Vs. Variable Rate Loans: What’s the difference?

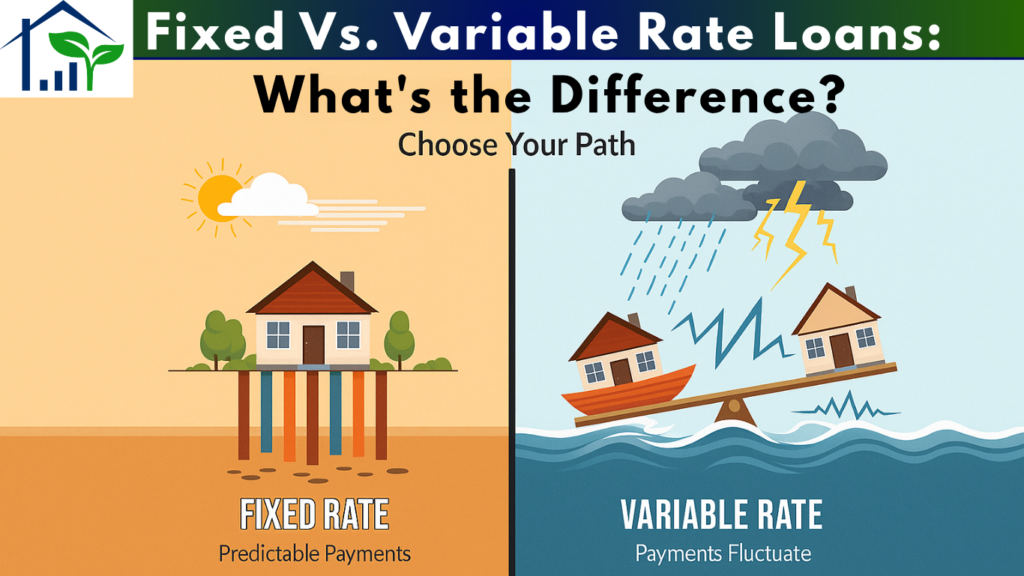

Fixed vs variable rate —When you’re considering a major loan — like a mortgage for a new home or a large personal loan — one of the first and most important decisions you’ll face is whether to go with a fixed or variable interest rate. This choice can significantly affect not just your monthly repayments, but also the total cost of your loan over time.

Understanding the difference between fixed and variable rates is key to choosing the right loan structure that aligns with your financial goals, lifestyle, and risk tolerance.

🔒 What is a Fixed Rate Loan?

A fixed-rate home loan locks in your interest rate for a specific term, usually between one and five years. During this period, your interest rate and your minimum monthly repayments will not change, regardless of any movements in the Reserve Bank of Australia (RBA) cash rate.

The primary benefit of a fixed rate is predictability. You know exactly what to expect each month, which makes budgeting simple and stress-free. Your payment won’t go up even if market interest rates skyrocket during your fixed-rate term.

🔄What is a Variable-Rate Loan?

A variable rate loan means your interest rate can go up or down based on changes in the market and the lender’s policies. Your loan repayments will vary accordingly.

Variable-rate loans are popular in Australia because of their flexibility. They typically come with a range of features that can help you pay off your loan faster and save on interest. These include:

- Offset accounts: An everyday transaction account linked to your home loan. The balance in this account is “offset” against your loan principal, reducing the amount of interest you pay.

- Redraw facility: Allows you to withdraw any extra repayments you have made on your loan.

- Unlimited extra repayments: You can pay off your loan as quickly as you like without incurring penalties.

🆚 Fixed vs Variable Rate: Which is Right for You?

The best option depends on your personal circumstances:

| Feature | Fixed-Rate Loan | Variable-Rate Loan |

|---|---|---|

| Interest Rate | Fixed for a set term (e.g., 1-5 years) | Fluctuates based on market and RBA changes |

| Monthly Payment | Stable and predictable for the fixed term | Can increase or decrease |

| Common Features | Fewer features; limited extra repayments and no offset accounts | More flexible; often includes offset accounts and redraw facilities |

| Risk | Protected from rising rates during the fixed term; risk of break costs | Exposed to rate rises; potential for lower payments if rates fall |

🧠 Final Thoughts

Choosing between a fixed and variable interest rate is an important decision when applying for a home loan. Take the time to assess your risk tolerance, future plans, and current financial position.

At Onvested Finance, we help you compare the best loan structures and guide you through the decision-making process — so you can borrow smarter and live better.