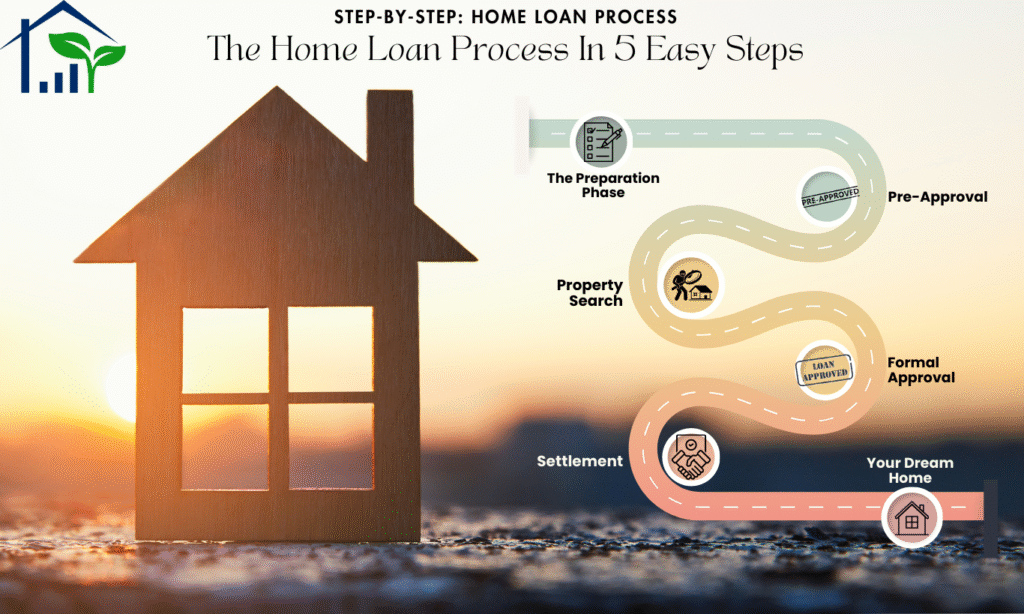

Step-by-Step: The Home Loan Process in 5 Easy Steps

Buying a home is one of the most significant milestones in life. But let’s be honest, the thought of securing a home loan can feel daunting. With so many documents, terms, and steps involved, it’s easy to get lost.

The good news? With the right information and guidance, the process becomes straightforward. At Onvested Finance, we’ve broken down the entire home loan process into five manageable steps. By following this guide, you’ll be well-prepared and confident on your journey to homeownership.

Let’s dive into the essential steps to buying a house:

Home Loan Process Step 1: Get Your Finances in Order (The Preparation Phase)

Before you even start looking at homes, you need to know what you can afford. This is arguably the most crucial step.

- Check Your Credit Score: Your credit score is a number that lenders use to assess your reliability as a borrower. A higher score can get you a better interest rate. You can request a free copy of your credit report from major credit bureaus.

- Determine Your Budget: Look at your income, savings, and existing debts. A good rule of thumb is that your monthly mortgage payment (including principal, interest, taxes, and insurance) should not exceed 28% of your gross monthly income.

- Save for a Down Payment: The more you can put down upfront, the less you’ll need to borrow and the lower your monthly payments will be. A 20% down payment is ideal, as it often allows you to avoid Lender Mortgage Insurance (LMI).

Pro Tip from Your Broker 💡: This is where our partnership begins. I’ll perform a comprehensive “health check” of your finances with you, often spotting opportunities to improve your credit score or manage your debt to increase your borrowing power. I’ll use my expertise to give you a realistic idea of what you can afford, saving you from the disappointment of looking at homes outside of your price range.

Home Loan Process Step 2: Get Pre-Approved (The Green Light)

Pre-approval is when a lender reviews your finances and provides an estimate of how much you can borrow. It’s not a final approval, but it gives you a clear direction as you begin your property search. Here’s why it matters:

-

Sets your borrowing limit 🏦

Instead of guessing what you can afford, pre-approval tells you exactly how much a lender is willing to lend. This helps you avoid wasting time looking at homes outside your budget and makes it easier to focus on realistic options. -

Helps you shop for properties with confidence 🏡

With a borrowing limit in place, you can attend inspections and auctions knowing where you stand financially. This confidence means you can act quickly if you find the right property, without second-guessing whether the bank will lend you enough. -

Shows sellers you’re a serious buyer 🤝

In competitive markets, sellers prefer buyers who already have pre-approval. It shows you’re financially prepared and less likely to have issues securing finance, which can make your offer more attractive compared to buyers without pre-approval.

Pro Tip 💡: A broker can help you secure pre-approval faster and compare offers from multiple lenders, giving you stronger buying power when you step into the market.

Home Loan Process Step 3: Find Your Dream Home & Make an Offer (The Exciting Part)

Now comes the fun part—house hunting! Once you’ve found the right home, you can make an offer knowing your budget is backed by pre-approval.

- Find Your Home: You and your real estate agent will find the perfect property that fits within your pre-approved budget.

- Make an Offer: Once you’ve found the one, your agent will help you draft an offer, which should include key contingencies.

- Crucial Action: Never sign a contract without having your legal expert review the documents.

Pro Tip 💡: Brokers stay by your side at this stage too. We can guide you on what to expect when making an offer and ensure your loan process stays on track once you’ve found your property.

Step 4: Formal Application & Underwriting

Once your offer is accepted, the real work begins. Your broker will help you lodge a formal loan application with the lender for the specific property you’ve chosen.

-

Submit Your Formal Loan Application 📝

This is a more detailed application that finalises your loan amount, structure, and terms. At this stage, your broker ensures all documents are complete and correctly submitted to avoid delays. -

The Underwriting Process 🔍

The lender’s underwriter will carefully review your documents. They’ll verify your income, assets, debts, and credit history. You may be asked for additional details—responding quickly helps keep the process moving smoothly. -

The Home Valuation 🏡

The lender orders a professional property valuation to confirm the home is worth the agreed purchase price. This protects both you and the lender from overpaying.

Once the lender is satisfied with all checks, they’ll issue formal (unconditional) approval, which means your loan is officially approved and you’re ready to move to settlement.

Pro Tip 💡: A broker knows exactly how to package and present your application so it passes through underwriting smoothly—minimizing the risk of hold-ups or rejections.

Step 5: Loan Settlement & Beyond

Settlement day is the finish line of your home loan journey. This is when the lender transfers the funds, contracts are completed, and ownership is officially transferred to you.

- Review Final Documents: Before settlement, you’ll receive your final loan documents outlining the exact terms of your loan, repayment schedule, and all associated fees.

- Attend Settlement: Your solicitor or conveyancer will guide you through signing the final paperwork and ensure the legal transfer of the property goes smoothly. Once completed—you officially take ownership of your home.🎉

But the journey doesn’t stop here. Life changes, and so do your financial needs. Reviewing your home loan regularly can save you money over the long term.

Pro Tip 💡: A great broker isn’t just there for the loan approval—they’ll support you post-settlement with loan reviews, refinancing opportunities, and future lending needs.

🏡 Home Loan Process in 5 Easy Steps (At a Glance)

| Step | What It Means | Borrower’s Action | Outcome |

|---|---|---|---|

| 1. Get Your Finances in Order | Prepare savings, reduce debts, gather documents | Save deposit, review budget, check credit | Ready for pre-approval |

| 2. Get Pre-Approved | Lender estimates how much you can borrow | Work with broker, compare lenders | Clear borrowing limit |

| 3. Find Your Dream Home & Make an Offer | Search and negotiate with confidence | House hunt, make offer | Offer accepted |

| 4. Formal Application & Underwriting | Lender checks financials & property valuation | Submit documents, wait for assessment | Formal (unconditional) approval |

| 5. Loan Settlement & Beyond | Loan funds transferred, keys handed over | Sign settlement documents | You’re a homeowner |

Final Thoughts

The home loan process doesn’t have to be complicated. By breaking it into these five clear steps—and working with an experienced mortgage broker—you’ll have expert guidance from start to finish.

👉 Ready to start your journey to homeownership? Contact Onvested Finance today and let us guide you through the process with confidence.