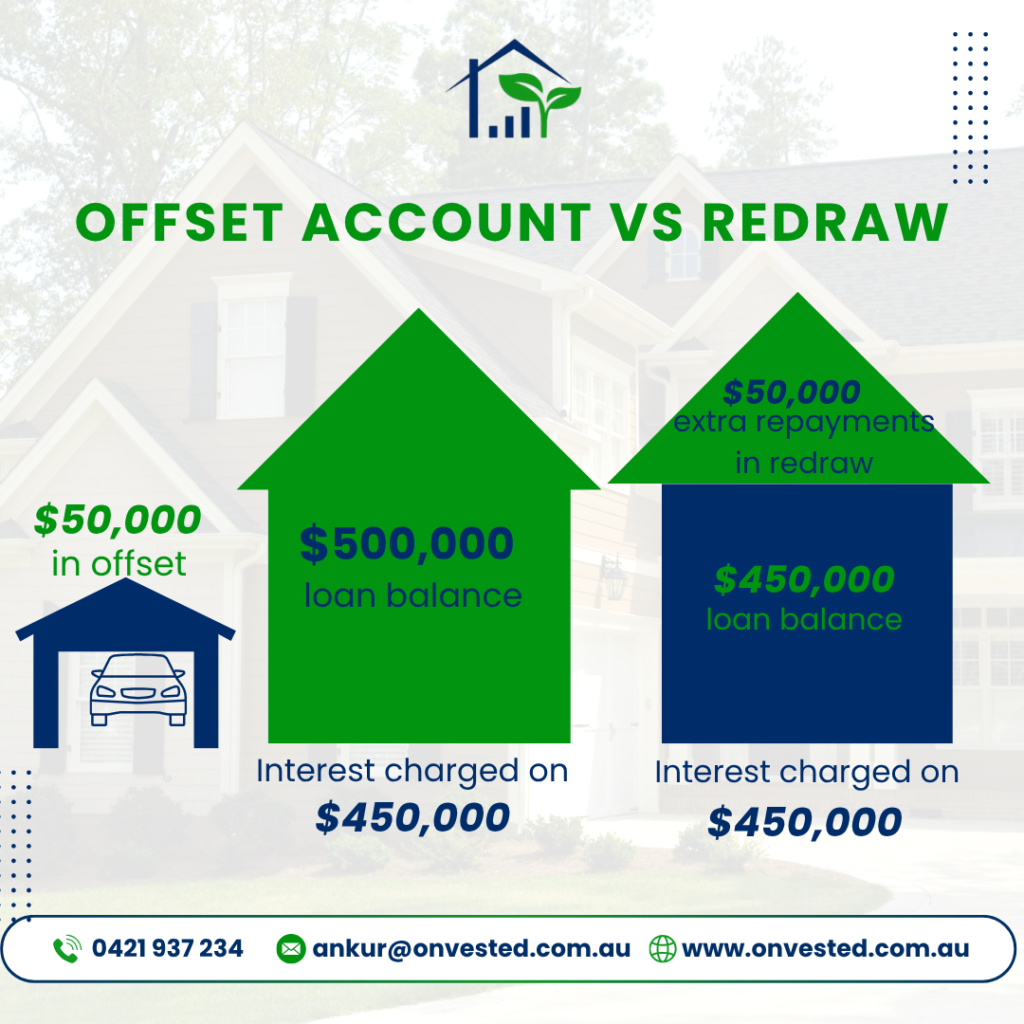

Offset vs Redraw explained – Learn how each option can reduce your home loan interest and help you repay your mortgage faster.

When managing a home loan, two powerful features can help you reduce interest and pay off your mortgage faster: Offset Accounts and Redraw Facilities. Let’s break them down!

🔹 Offset Account

An offset account works like a transaction or savings account linked to your home loan.

-

✅ The balance offsets your loan, reducing the interest charged.

-

✅ For example, if your loan is $400,000 and your offset has $20,000, you only pay interest on $380,000.

-

✅ You can withdraw funds anytime, just like a regular bank account.

🔹 Redraw Facility

This allows you to access any extra repayments you’ve made on your loan.

-

✅ Paid more than the required amount? You can redraw the extra funds when needed.

-

✅ It’s helpful for emergencies or unexpected expenses.

-

✅ Access may take longer than with an offset account.

Offset vs Redraw: A Quick Comparison

| Feature | Offset Account | Redraw Facility |

|---|---|---|

| Access to Funds | Instant (like a bank account) | May take time or need approval |

| Interest Savings | Yes (daily offset) | Yes (reduced loan principal) |

| Tax Efficiency | Can benefit investors | No direct tax advantage |

| Loan Type | Usually variable | Works with both variable and some fixed loans |

So, Which Is Right for You?

💡 Choose an Offset Account if you want everyday access to your savings and want to cut down on interest.

💡 Go with a Redraw Facility if you’re making extra repayments and want access to funds only when needed.

How They Help Your Home Loan

Both features reduce the principal balance used to calculate your interest. That means:

-

🔸 Less interest paid over the life of your loan

-

🔸 Faster loan repayment

-

🔸 Greater financial flexibility

📞 Want tailored advice?

Get in touch with us at Onvested Finance to find the option that suits you best.